As real estate markets change in 2026, hard money loan rates will still be a significant factor for investors and borrowers who need quick, flexible financing. Hard money loan rates are affected by different things than regular mortgage rates. Knowing what these things are will help you make better borrowing selections for your next project.

What Are the Rates for Hard Money Loans?

Hard money loan rates are the interest rates that private lenders charge for short-term, asset-based loans. Because hard money loans are meant to be quick to finance, don’t need strict credit checks, and are mostly backed by the value of the property, these rates are usually higher than regular mortgage rates.

People typically employ hard money loans for fix-and-flip ventures, bridging loans, construction financing, and other unusual investment opportunities.

Hard Money Rates in 2026: What to Expect

Hard money loan rates usually vary from 10% to 14% per year in 2026, but the exact rates depend on a few important things. These interest rates are higher than those on regular bank loans, but hard money lenders can close deals in only a few days, which can be a big plus for real estate investors who need money urgently.

These numbers are just rough estimates and can change depending on the lender, the state of the market, and the borrower’s credentials.

Factors That Influence Hard Money Loan Rates

There are a number of things that affect the interest rate on a hard money loan:

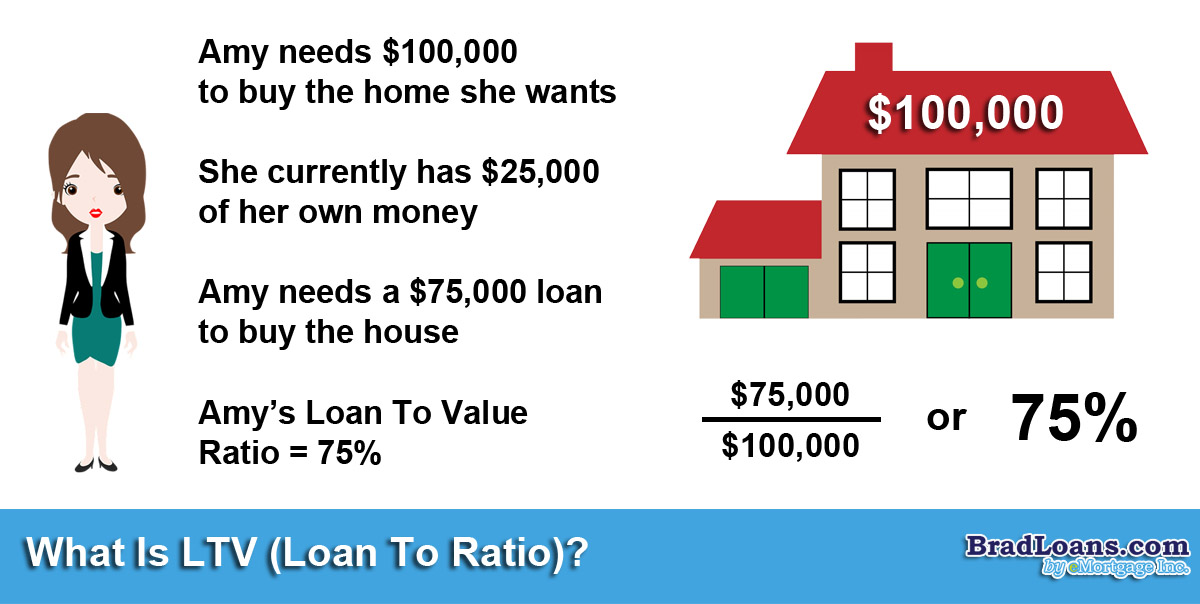

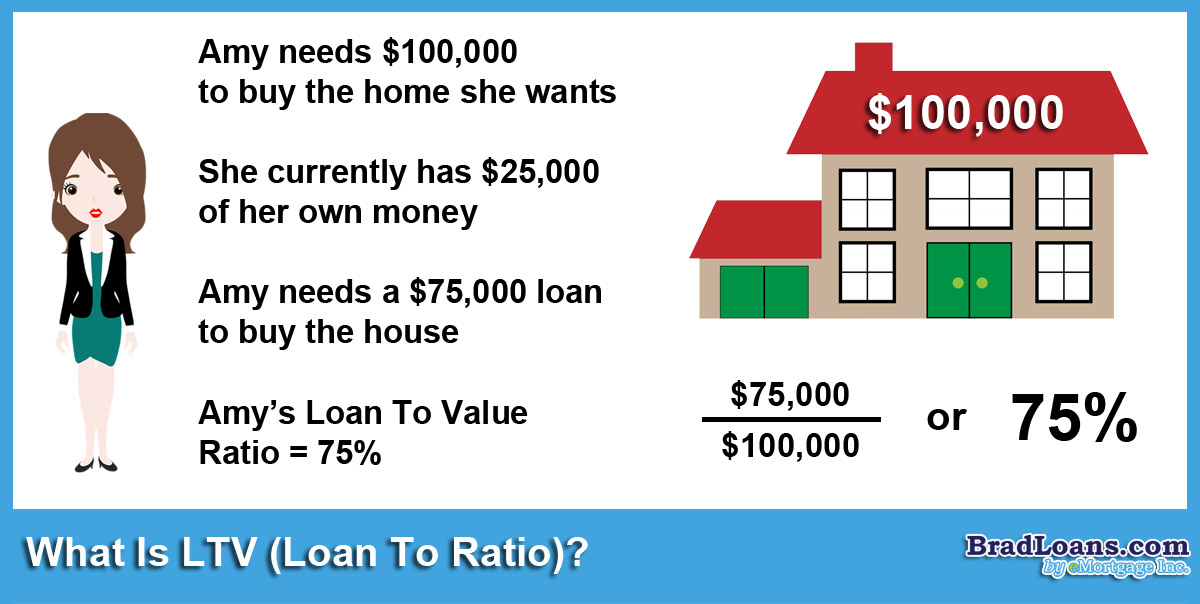

The Loan-to-Value (LTV) Ratio: Lower LTV ratios usually mean better rates because the lender’s risk is lower. In 2026, a lot of hard money lenders want LTV levels between 65% and 75%.

Credit Profile: Hard money loans are more concerned with the value of the property, but having a good credit history can still help you get good rates.

Type and condition of the property: Properties that are in better shape or have a higher resale value usually get cheaper interest rates. Properties that are in bad shape or that are not typical may cost more.

Market Dynamics: Lenders change the prices of hard money loans based on the level of risk they are willing to take on. This is because local real estate activity, interest rate patterns, and the state of the economy all affect the prices of these loans.

Points and Fees You Should Know

Hard money loans usually come with origination points and fees in addition to interest rates. It’s normal to have to pay 2 to 4 points up front, which means you pay that percentage of the loan amount when you close.

Knowing these fees lets you compare the overall cost of borrowing, not just the interest rate, when you look at lenders.

The Hard Money Tradeoff: Rate vs. Speed

Hard money loans are mostly about speed and chance. It can take traditional lenders weeks or even months to accept a loan, but hard money lenders can typically do it in only a few days. The higher rate can be a strategic cost of doing business for investors looking for auctions, fix-and-flip deals, or bridge loans.

Do Hard Money Loans Make Sense in 2026?

If you need money quickly, hard money loans with low interest rates can open up real estate options that regular loans can’t. The most important thing is to understand how rates are set and what affects them so you can get terms that fit your plan.

Moving Forward

Are you ready to look into the interest rates on hard money loans for your next project? Brad Loans has quick, clear loan solutions that are made just for you. Call us today to compare rates, talk about your goals, and obtain a personalized hard money loan quotation in 2026.

Phoenix Hard Money Real Estate Loans

If you’re interested in getting involved with real estate investing and need the capital to purchase properties hard money is a great way to get started. Brad Loans has extensive experience in both real estate investing and hard money lending and is proud to offer Phoenix Valley real estate investors the financing they need. It is easy to get started applying for hard money loan and Brad Loans is able to work with clients with bad credit and no credit. We are your source for hard money when traditional banks say no. Read more about Brad Loan’s hard money loan programs or get started fill out our hard money loan application or give us a call to ask questions at 602-999-9499.