This post is especially for NEW INVESTORS. However, any investor who plans to fund a deal with a hard money loan will benefit from the information here.

A Hard Money Loan for Your First Deal

Your first deal as a real estate investor is the most important deal of your career. It’s the deal that gets your foot in the door of the real estate investing game. For most new investors, the success of that first deal is going to depend on whether or not you get a hard money loan to fund it.

“Why a Hard Money Loan for My First Deal?”

That’s a great question! Answer: Hard money loans are almost always the only type of loan that new investors can get for their first deal or two until they build some capital.

That being said about using a hard money loan for your first deal . . . I suggest that you think like a tourist when you invest.

New Investors Should Think Like Tourists

Going on vacation involves a lot of planning, and the most important part to figure out before you go on vacation is where to go. Planning your first real estate investment deal is exactly the same. Where you invest is the most important part of your planning.

The reason? Just like with your vacation, you want to make sure that you get the most bang for your buck when you invest. We’re all probably well-aware that some places are hotter for real estate investing than others because of market conditions. So, that’s the first part of it.

The other part may not be as familiar to you . . . Did you know that some states are better than others for getting approved for a hard money loan?

It’s true. Most of it has to do with lending and real estate laws that differ from state to state. Some of these laws are hostile to the real estate investing and hard money lending processes — stuff we can blame our congressmen/women for.

So even if you find a really killer deal in some states, you could end up flat on your face with no way to get the funding you need, unless you know the best places to invest in real estate when it comes to hard money loan approval.

The Best Places to Invest in Real Estate

Simply put, the best places for new investors to invest are states where the markets are good and where you have the best chances to get approved for your hard money loan.

Here are those states: Arizona, Colorado, Georgia, Nevada, North Carolina, Oregon, Texas, Virginia, and Washington. These are the best states to invest in for new investors. Stick to these ones, and you can count on hot markets, good deals, and easy hard money loan approval.

What Other Hard Money Lenders “Forget” to Tell You

- I could get a lot of flak from other hard money lenders out there for telling you this, but I don’t care.

- I’m sick and tired of hearing about hard money lenders who take advantage of investors (especially new investors) by feeding them mis-information about what it takes to close a deal.

- Sometimes it’s even worse when they give no information at all.

- All they want is to get the investor’s money, so they conveniently “forget” to inform them of some of the most critical realities of real estate investing.

- I’m talking specifically about the starting money that investors need to make a deal, expenses not covered by the loans used to purchase the property.

- (Yes, in addition to these loans, you need other monies to fund your deal. If this comes as a surprise to you, then you are exactly why were writing this post.)

Three Types of 100% Financing

Chances are that you didn’t even know there are 3 different kinds of 100% financing for real estate investment deals.

Don’t feel bad. It’s not your fault. The reason for the obscurity on this topic is because nobody ever talks about it. So I’m going to spell it out here once and for all.

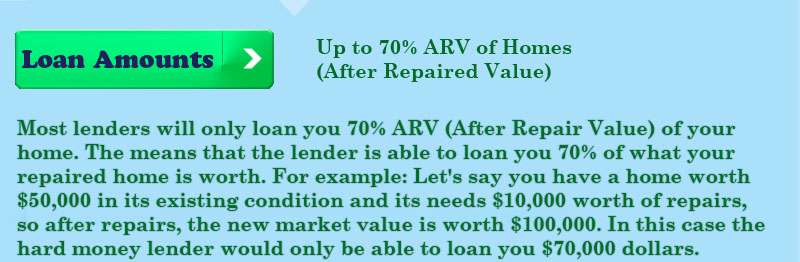

As you probably do know, the majority of hard money loans cover somewhere between 60% and 75% of the property value or after repair value of the property. If the deal you found is a slammin’ one — such as the case with my caller the other day — a hard money lender might choose to finance the deal 100%. This leads into the first type of 100% financing.

Type #1 – This first type of 100% financing covers 100% of the purchase price of the property. But that’s it. You still have to pay for repair costs, closing costs, earnest money and all those other fees on your own. This type is what most lenders mean when they use the phrase “100% financing.”

Type #2 – Very rarely, and only if your deal is a really really slammin’ one, a hard money lender may finance repair costs and the closing costs in addition to the purchase price of the property. The investor must still bring what I call “starting money” (earnest money, evaluation fees, inspection fees, etc.) to the table.

Type #3 – The Holy Grail of investment financing! True 100% financing for everything — purchase price, rehab/repair costs, closing costs and all those starting money items. This financing option is the only way for investors to get into deals without any money of their own whatsoever, and practically nobody offers it. (But we do.)

With that wind-up you’re probably dying to hear about how we accomplish true 100% financing for our clients. I’m going to explain that in just a minute, but first I have something important to say about starting money.

Turn $1,000 Dollars into $10,000

Here’s a table that itemizes those things for you:

| Common Starting Money Items | |

| Item | Cost |

| Earnest Money | $500 – $1,000 |

| Evaluation | $600 |

| Inspection | $500 |

| Total: | $1,600 – $2,100 |

Starting money. This is the term that I use for earnest money, evaluation costs, inspection fees and other expenses that investors almost always have to fund for themselves.

These expenses are the most commonly overlooked aspects of every real estate investment deal.

It is possible to get a true 100% financing option to cover these expenses. This is especially helpful for new investors who don’t have their own starting money.

However, the majority of investors out there will have to cover these costs themselves on most deals.

If you’re making a lot of offers or planning to make a lot of offers, doing some simple math in your head should tell you that these costs can add up fast. For many investors, lack of start up money is the number one thing holding them back from making more offers. To get the money you need, faster than the competition, consider a hard money loan from Brad Loans.