Interest rates on hard money loans are much higher than traditional bank financed loans. The first reason why conventional residential or commercial property loans because there is a higher risk involved and shorter duration of financing. Interest rates are also dependent on how the real estate market is doing and the amount of hard money credit available.

Another factor is that most borrowers who use hard money need their loans quickly to purchase property at a profitable discount but their lack of credit requirements or debt make it almost impossible to get conventional Bank financed loans.

View the info-graphic and information below to find out the common interest rates of hard money lenders, how location and condition of your property effects points/interest rates and other loan fees associated with hard money lending.

Contents:

- Infographic

- Hard Money Interest Rates

- Hard Money Points

- Loan Fees

- Loan Terms & Amounts

- Interest Considerations

- Points & Fees Consideration

- Conclusion

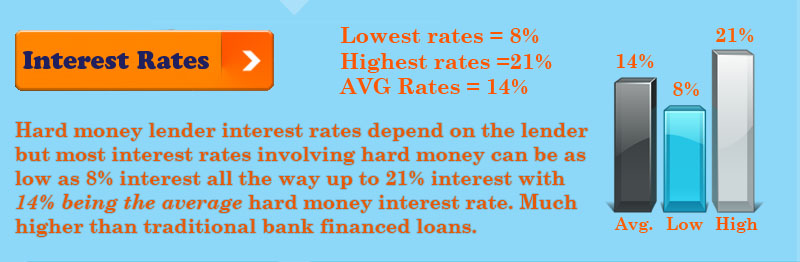

Interest Rates On Hard Money?

Hard money lender’s interest rates depend on the lender. Common hard money interest rates can be as low as 8% interest all the way up to 21% interest with the average hard money interest rate falling in at 14%, and terms can last for 6 months to a few years. Some lending companies will defer your interest payments, being that most lenders don’t want interest payments during the rehab phase.

Default Interest Rates On Hard Money

When borrower’s default on hard money loans they might be charged a higher “Default Rate”. Default rates are controlled by law and have a cap, defaulting on a hard money loan could leave you stuck paying extremely high percentages upwards of 25%–29%. Some private money lenders will collect a pre-payment penalty and some offer loans with no pre-payment penalties.

Credit Scores Effect On Interest Rates

Credit scores of the borrower weigh heavily on interest rates, especially with hard money lenders. The borrower’s experience and ownership of property might also have an effect on the given interest rate by the lender.

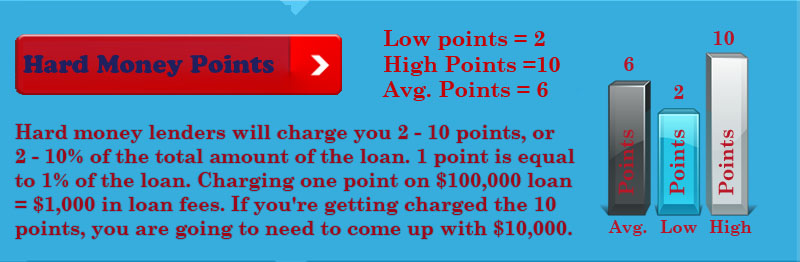

Hard Money Points

Not only will there be interest but hard money lenders also charge loan fees on your hard money loan. Typically, hard money lenders will charge you 2 – 10 points, or 2 – 10% of the total amount of the loan, this is referred to as your loan fee. It pretty common for a commercial hard money loans to start at four points, and go as high as 10 full points. 1 point is equal to 1% of the mortgage loan. Therefore, charging one point on $100,000 loan = $1,000 in loan fees. If you’re getting charged the 10 points, you are going to need to come up with $10,000 for the loan fee.

Loan Fees Associated

For investors that are used to traditional bank loans only having 1% or lower loan fees, this higher percentage can be a “shocker”. Usually this loan fee is set in stone and isn’t effected by experience, credit or the property’s characteristics.

Another factor that should be taken into consideration is the amount of time it takes for the lender to fund the loan. If you are new to their company it might take a little longer than someone else that has already had a loan funded previously. Taking this into account, it’s a smart decision to find a hard money lender that you can build a rapport with for future lending purposes. You want to be able to get your loan funded as fast as possible when trying to take advantages of great investment properties.

Loan Terms & ARV (After Repair Value) Amounts

You want to find a hard money lender with terms that suit your needs. Here are the basic terms hard money lenders offer. Most lenders will only loan you 70% ARV (After Repair Value) of your home. The means that the lender is able to loan you 70% of what your repaired home is worth. For example: Let’s say you have a home worth $50,000 in its existing condition and its needs $10,000 worth of repairs, so after repairs, the new market value is worth $100,000. In this case the hard money lender would only be able to loan you $70,000 dollars.

**Important: All borrowers of hard money should use a real estate attorney to make sure your property is not sold or given away by you going into default or having late payments. Most of these procedures could be stopped by a credible real estate attorney and would require a court judgment.

How The Location & Condition Of Your Property Effects Loan Points & Interest Rates

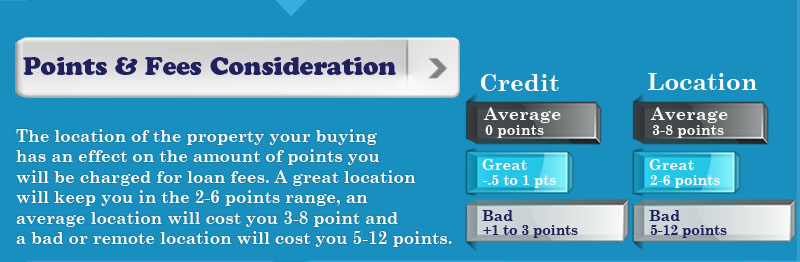

Locations Effect On Points

The location of the property your buying has an effect on the amount of points you will be charged for loan fees. A great location will keep you in the 2-6 points range, an average location will cost you 3-8 point and a bad or remote location will cost you 5-12 points.

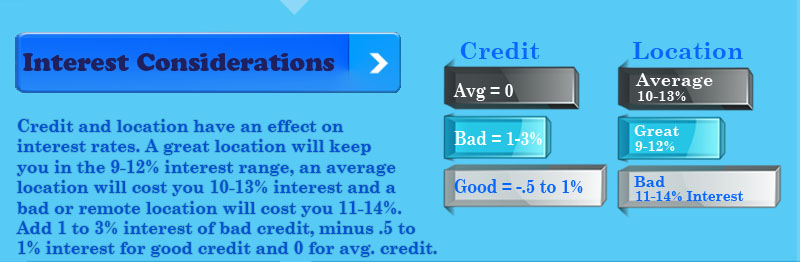

Location’s Effect On Interest Rates

The location of the property your buying also has an effect on the interest rate you will be charged for loan fees. A great location will keep you in the 9-12% interest range, an average location will cost you 10-13% interest and a bad or remote location will cost you 11-14% interest on top of your financed loan amount.

Condition Of Property’s Effect On Points

Depending on the condition of your property, you may have to pay additional loan fees. A property in bad condition will cost you an additional 1 to 3 points. A property in average condition won’t cost you any additional but a property in great condition could actually save you 1 to 2 points off of your loan fee.

Condition Of The Property’s Effect On Interest Rates

Depending on the condition of your property, you may have to pay additional loan fees. A property in bad condition will cost you an additional 1 to 3% interest. A property in average condition won’t cost you any additional but a property in great condition could actually save you .5 to 1% off of your interest rate.

Credit Scores Impact On Interest Rates & Points On Hard Money Loans

Credit’s Effect On Points

Credit scores impact the amount of points you will be charged in additional loan fees. Bad credit will raise your loan 1 to 3 points. Average credit will not affect your loan and great credit could possibly get you a discount of .5 to 1 point.

Credit’s Effect On Interest Rates

Credit scores also impact the amount of additional interest you will be charged on top of your loan fees. Bad credit will raise your rate 1 to 3%. Average credit will not affect your loan and great credit may get you a discount of .5 to 1%.

Conclusion:

It’s safe to say that if you are looking for a hard money loan, make sure that you have good credit, your property is in a good location/condition and that you are able to make payments on time to avoid the costly fees associated with hard money lending/financing.

Loan Programs, Rates & Fees We Offer in Phoenix, AZ: No Pre-Payment Penalty

OWNER OCC OR INVESTOR 20-30 YEAR FULLY AMORTIZED 70% LTV

- 11.99% – cost: greater of $3,000 or 6 points + $1,920 eMortgage fees

- 13.99% – cost: greater of $2,000 or 4 points + $1,920 eMortgage fees

- No pre-payment penalty

- Purchase or Refinance

OWNER OCC ONLY 20-30 YEAR FULLY AMORTIZED 80% LTV

- 12.99% – cost: greater of $3,000 or 6 points + $1,920 eMortgage fees

- 14.99% – cost: greater of $2,000 or 4 points + $1,920 eMortgage fees

- No pre-payment penalty

- Purchase or Refinance

OWNER OCC ONLY RE-FINANCE 20-30 YEAR FULLY AMORTIZED 65% LTV

- 14.99% – cost: (NO Points!) $1,920 eMortgage fees

- No pre-payment penalty

- Owner Occupied Refinance only

- Interest Rate Buy Down Fee: 2% of loan amount for 1% of reduction in interest rate

FIX & FLIP INVESTOR ONLY ONE YEAR 70% LTV

Interest Only

- 15.99%

- 0 points

- $1,920 eMortgage fees

- 4 month interest minimum

- No pre-payment penalty

- Purchase or Refinance

INVESTOR ONLY 20-30 YEAR AMORTIZATION 70% LTV

- 11.99% – cost: greater of $3,000 or 6 points + $1,920 eMortgage fees

- 13.99% – cost: greater of $2,000 or 4 points + $1,920 eMortgage fees

- Refinance or Purchase

- No pre-payment penalty

- Purchase or Refinance