What is the Loan-to-Value (LTV) Ratio and Why Does It Matter for Getting a Loan?

Lenders need a quick and accurate way to figure out how risky a loan is when you apply for one, whether it’s a personal loan, an auto loan, or a title loan. The Loan-to-Value (LTV) ratio is one of the most essential instruments they have. If you want to borrow money against your car or another asset, knowing about LTV can help you figure out what to expect, what you can receive, and how to secure the best deal.

What Is LTV, Exactly?

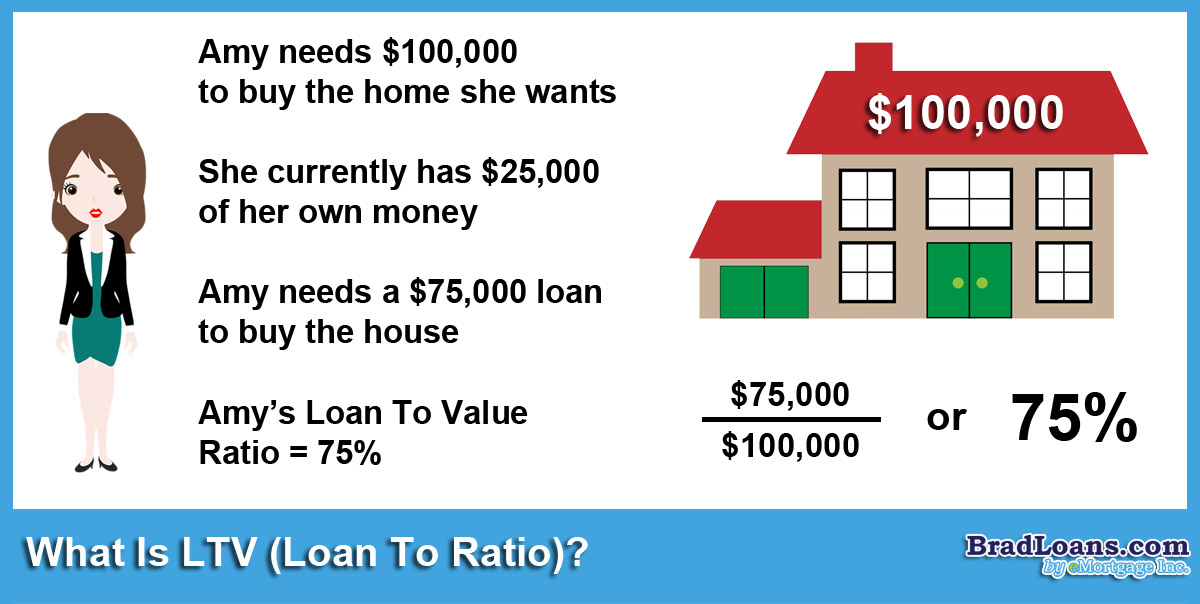

The Loan-to-Value Ratio (LTV) is a statistic that shows how much you want to borrow compared to the value of the asset you want to borrow against. It is written as a percentage:

LTV = (Loan Amount ÷ Appraised Value of Asset) × 100

The LTV is 50% if you borrow $4,000 on a car that is worth $8,000. The lender can see how much of the asset’s value is being used as collateral.

Why LTV Is So Important

LTV is very important to lenders since it tells them how risky a loan is.

Less LTV means less risk.

The lender has a lot of protection when the loan amount is minimal relative to the value of the asset. This usually implies that you can get your loan approved sooner, get a better interest rate, or borrow more money.

More LTV means more risk.

The lender is less protected if the asset loses value or needs to be sold if the loan amount is close to the asset’s worth. People that borrow money with high LTV ratios may have to meet tougher standards, pay higher interest rates, or get less money.

At BradLoans.com, we do our best to look at each application on its own, but LTV is still one of the most important things that decides how much you can borrow.

How LTV Changes Auto and Title Loans

LTV is very important for auto-title loans because your car is the collateral. A lender looks at the make, model, year, mileage, and overall condition of your car to figure out how much it is worth. After that value is known, the LTV rules are used to figure out how much the loan will be.

Most title lenders will grant you money in the 40% to 70% LTV range, depending on how good the car is and how much money you have. A automobile that is well-kept and has minimal mileage can typically get the higher end of the spectrum.

How to Make Your LTV Ratio Better

Here are some useful tips to help you get approved or get a bigger loan:

Keep your car in good shape to keep its worth.

Make modest fixes or upgrades that make things look or work better.

Bring comprehensive and precise paperwork so the appraiser can check the worth.

Think about borrowing less, which will lower your LTV right now.

Even tiny changes can change your ratio enough to get you better loan conditions.

The Bottom Line

The Loan-to-Value ratio is one of the most crucial numbers on any application for a secured loan. You may borrow money with more confidence and responsibility if you know how LTV works and how lenders use it. At BradLoans.com, we promise to be honest about lending, make things straightforward, and help our customers acquire the money they need without any uncertainty.

Start your safe online application today if you want to find out what kind of loan you can get.

Brad Loans Offers Up To 100% LTV With Cross Collateral

Brad Loans offers 100% FINANCING if borrower has an another property that is free and clear or the property that has positive equity (it’s worth more than is still owed), it can be pledged as additional collateral (aka a Cross Collateralized Loan). Learn more about 100% LTV hard money loans here.