Fill out our hard money loan application below. It’s fast, it’s easy and it’s secure!

Rewards of Flipping Houses In The Phoenix Valley In 2026

Flipping houses has never been a way to become rich quickly, but in the Phoenix Valley, it still pays off for investors who are patient, plan ahead, and have reasonable expectations. With a growing population and a sustained demand for new houses, 2026 is still a great [...]

Risks of Flipping Houses In The Phoenix Valley In 2026

House flipping has been popular in the Phoenix Valley for a long time since the population is growing quickly, there is a consistent need for housing, and the areas are nice. There is a chance to make money by flipping homes in 2026, but there are also [...]

Hard Money Loan Rates 2026

As real estate markets change in 2026, hard money loan rates will still be a significant factor for investors and borrowers who need quick, flexible financing. Hard money loan rates are affected by different things than regular mortgage rates. Knowing what these things are will help you [...]

Uses For A Hard Money Loan in 2026

Hard money loans are still very significant for real estate investing and short-term finance in 2026. Hard money loans are based on assets, are easier to get, and are more flexible than regular bank loans. They are often employed when the timing, condition of the property, or [...]

What Is a Zero-Down Hard Money Loan?

For real estate investors who want to move quickly on a great deal, few tools are more powerful than a hard money loan. These loans are designed for speed, flexibility, and asset-based decision-making rather than the strict requirements of a traditional bank. But what about the much-talked-about […]

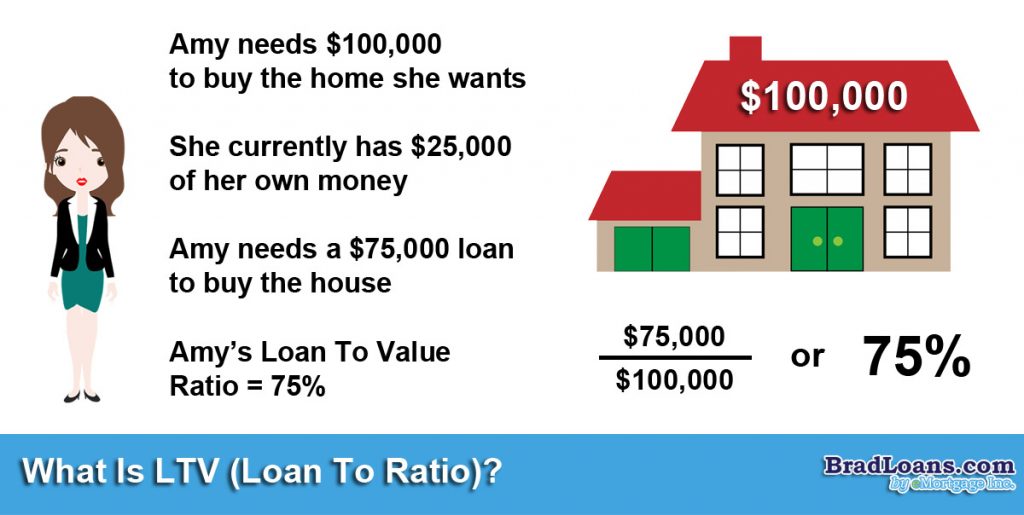

Understanding Loan-to-Value (LTV) Ratio

What is the Loan-to-Value (LTV) Ratio and Why Does It Matter for Getting a Loan? Lenders need a quick and accurate way to figure out how risky a loan is when you apply for one, whether it’s a personal loan, an auto loan, or a title loan. […]

Finding the Right Hard Money Lender for Your Primary Residence

Finding a hard money lender that is a good fit for your home is like searching for a soulmate. You should look into many loan providers to choose the one that is most suited to your situation. Find the best lender for your needs by comparing their [...]

Flipping Houses In Arizona Guide

Real estate speculators are flocking to Phoenix, Arizona, to cash in on the city's booming economy, large population, and thriving property market by flipping houses. Whatever your level of experience as a property flipper, Phoenix provides a one-of-a-kind setting in which to make a profit. Anyone interested [...]

When You Cannot Repay Your Hard Money Loan

Hard money lending is frequently an excellent solution for real estate investors who are in need of cash in a hurry and who possess a wide range of terms and payment schedules to choose from. Despite the fact that many lenders are aware of the individual circumstances [...]

Questions To Ask Before You Get A Hard Money Loan

The process of obtaining a hard money loan is substantially less difficult than that of obtaining a bank loan; nonetheless, applicants still need to be aware of what they are getting themselves into before submitting an application. There are five questions that you should ask yourself before [...]

Telephone No.602-999-9499